Chipmakers Surge on AI Demand (and Face Export Drama)

Nvidia Hits New High on China Sales: Nvidia’s stock briefly touched an all-time high after news it secured a 300,000-unit order for its H20 AI chips destined for China nasdaq.com investopedia.com. This export-compliant version of its flagship GPU was developed to skirt U.S. trade curbs, and Washington’s recent reversal of an April ban now allows Nvidia to resume H20 shipments to China reuters.com. The massive order – adding to an existing inventory of ~700,000 H20 chips – underscores insatiable overseas demand despite prior export restrictions reuters.com. “The U.S. government has assured NVIDIA that licenses will be granted, and NVIDIA hopes to start deliveries soon,” the company noted, highlighting an easing of tensions investopedia.com. Nvidia’s share price gave back some gains by Tuesday’s close on mild profit-taking, but the bullish narrative remains intact: global AI infrastructure build-outs are driving unprecedented demand for its chips.

AMD & Broadcom Riding the Wave: Nvidia’s rivals are rallying in tandem. Advanced Micro Devices (AMD) jumped over 2% to a fresh 52-week high around $177 nasdaq.com, buoyed by optimism about its upcoming MI300/MI350 accelerators. In fact, HSBC analysts upgraded AMD to “Buy” earlier this month, doubling their price target to $200 after tests showed AMD’s latest MI350 GPUs can compete head-to-head with Nvidia’s cutting-edge Blackwell chips investopedia.com. AMD’s strategic partnership with OpenAI – highlighted by CEO Lisa Su alongside Sam Altman at a June event – is seen as a vote of confidence in its AI roadmap investopedia.com. Broadcom, another beneficiary of the AI boom, climbed about 1% to a record high as well nasdaq.com. The chip designer expects AI-related revenues to surge 60% this quarter (to ~$5.1 billion) as cloud giants snap up its custom accelerators, and its recent VMware acquisition is bolstering its AI-driven networking business finance.yahoo.com. Even traditional semiconductor firms are finding new life: electronic design software maker Cadence reported robust earnings and raised its outlook, citing broad strength in “various areas within the AI space” driving demand for its chip design tools investopedia.com. (One dark cloud: Cadence also revealed a $140 million penalty to settle charges of unlawful export of EDA software to China investopedia.com, a reminder that geopolitics still loom over the sector.)

Analysts Still Bullish – But Watch Valuations: Wall Street broadly remains upbeat on the chipmakers at the heart of the AI revolution. Citi analysts, for example, hiked their Nvidia price target to $190 (from $180) this month, noting Nvidia is “involved in essentially every sovereign [AI] deal” as governments race to build national AI supercomputers investopedia.com. They project the AI data center market will reach $563 billion by 2028, significantly higher than prior forecasts investopedia.com. That said, a few skeptics warn of overheating. In early July, Citi’s equity strategists even described an emerging “AI bubble” in tech stocks, albeit one that could “roar on” for now businessinsider.com. And in a sobering caution, one economist told reporters that today’s AI euphoria might be “worse than the dot-com” era, with extreme valuations that could lead to “catastrophic consequences” if the boom unravels tomshardware.com. For the moment, however, chipmakers and their investors are enjoying the ride, riding a virtuous cycle of hype, capital spending, and genuine revenue growth fueled by AI demand.

Big Tech Earnings: Betting Billions on AI

Alphabet’s $85 Billion AI Spending Spree: Google’s parent Alphabet delivered a standout Q2 earnings beat, crediting new AI features in Search and YouTube for much of its 14% revenue jump reuters.com reuters.com. More striking was management’s aggressive capex plans: Alphabet surprised investors by boosting 2025 capital expenditures to $85 billion (up $10 B), specifically to expand its AI cloud infrastructure reuters.com. CEO Sundar Pichai said demand for Google Cloud’s AI-driven services (which saw a 32% sales surge in Q2) justified “increasing our investment in capital expenditures” reuters.com. This 13% capex hike – largely aimed at data centers and advanced chips – signals that Google is “leaning more into artificial-intelligence technology,” according to analysts accesswdun.com. Alphabet’s stock rose about 1% on the news, hitting fresh highs as AI optimism outweighed concerns about rising costs accesswdun.com. The company noted it is developing proprietary TPUs and other AI accelerators to reduce reliance on third-party chips, and is even exploring custom “AI chips and other investments” alongside the likes of Nvidia accesswdun.com.

Microsoft and Meta Join the Spending Race: Rival Microsoft likewise highlighted AI as a core growth driver in its results (released a week earlier). Azure’s AI cloud usage has been “scaling rapidly,” management noted, thanks to big wins like the Azure-OpenAI service and the upcoming Copilot features being infused across Office and Windows. Microsoft is reportedly upping its data-center spend significantly to support OpenAI’s models and its own copilots, though exact figures are under wraps. Meanwhile, Meta Platforms is set to report after Wednesday’s close (July 30), and the market is anxious to see if its massive AI investments will pay off. Meta has been pouring money into AI – an estimated $60–70 billion in 2025 capital expenditures primarily for AI infrastructure ig.com – in hopes of keeping Facebook, Instagram and its “metaverse” offerings at the cutting edge. This spending includes building out custom AI supercomputers and new data centers optimized for machine learning, as well as deploying generative AI features across its apps (from chatbots to ad tools). So far, Meta’s advertising business has seen some lift from AI-driven content recommendations, with revenue per user up ~11% year-on-year ig.com. But profit margins have slipped due to the heavy tech spend. As one market analyst put it, the key question is “Can Meta maintain 40%+ margins while burning $70 billion on AI infrastructure?” ig.com. Any hints from CEO Mark Zuckerberg on cost discipline (or lack thereof) in the earnings call will likely move the stock. Investors will also be watching for updates on Meta’s in-house AI chips and its efforts in AI-powered hardware like smart glasses – especially after rival Amazon just made a splash in that arena (more on that below).

Cloud and Enterprise Software Upside: The AI wave is lifting more than just the consumer-facing tech giants. Enterprise software firms are also cashing in. For instance, Microsoft-owned GitHub and Salesforce both announced new AI features this week aimed at increasing developer productivity and sales efficiency, respectively – part of a trend of “AI everywhere” in software. Smaller players are seeing boosts too: Cadence Design Systems, as noted, cited AI as a catalyst for strong electronic design tool sales investopedia.com. Another example is Corning Inc., the industrial glass and fiber-optics supplier, which shocked Wall Street with better-than-expected earnings thanks in part to “AI-driven demand” for its fiber-optic cables investopedia.com investopedia.com. Corning said major cloud data center builders have been aggressively buying its optical fiber and components to wire the new AI superclusters, helping drive a 12% stock surge on Tuesday investopedia.com. Even legacy industrials and utilities are now touting AI adoption on their earnings calls. In short, AI has become a cross-industry theme this earnings season – from cloud computing to telecom hardware – with many companies attributing surprise revenue upticks to AI projects or usage.

Beyond Tech: AI Deals, M&A and New Entrants

M&A Heats Up – Grammarly, Amazon and More: The gold rush mentality in AI is spurring mergers and acquisitions, as companies seek to acquire talent and technology. Earlier in July, Grammarly – the digital writing assistant valued at $13 billion – agreed to buy Superhuman, a buzzy AI-driven email startup, as part of its expansion into a full “AI productivity suite” reuters.com. Superhuman, once valued at $825 M, uses AI to help users write and respond to email faster; now its features will integrate with Grammarly’s generative text AI to broaden enterprise offerings reuters.com reuters.com. In the hardware realm, Amazon made headlines by acquiring Bee, a startup that makes a wearable AI recorder. Bee’s wristband device constantly listens to conversations (unless muted) and uses AI to turn them into reminders and to-do lists. Amazon confirmed the deal (announced by Bee’s founder on July 22) as it eyes new frontiers beyond Alexa – envisioning “personal, ambient intelligence” gadgets for consumers techcrunch.com techcrunch.com. The move positions Amazon against the likes of OpenAI (which is reportedly building AI hardware) and Meta (which has AI-enabled smart glasses in the works) techcrunch.com. Market-watchers say this acquisition underscores that wearable and consumer AI is the next battleground, merging AI with IoT devices – though privacy concerns abound, as Bee and Amazon will need strict policies for devices that “record everything around them” by design techcrunch.com techcrunch.com. Also in the rumor mill: Apple is eyeing a $14 Billion purchase of Perplexity AI, a startup building an AI search chatbot, in what would be its boldest AI move yet (Apple has lagged on AI and analysts say a big buy may be its only option) techfundingnews.com fortune.com. And chip giant Nvidia has reportedly been in talks to acquire Canadian AI startup CentML for over $300 M to bolster its software optimization capabilities thelogic.co. If this frenzy of deal-making proves anything, it’s that no one wants to be left behind in the AI arms race – and incumbents will spend big to acquire innovative upstarts and specialized AI teams.

New Players and “AI Startups 2.0”: The late-July market chatter also includes the next wave of AI entrants. Several high-profile startups are preparing IPOs or funding rounds. OpenAI’s CEO has hinted at potential plans to build consumer devices (possibly in partnership with ex-Apple design guru Jony Ive capacitymedia.com), which could shake up the hardware landscape. Meanwhile, industry insiders point to companies like Anthropic, xAI, and ScaleAI as “ones to watch” – these firms, backed by heavy venture funding, are working on everything from large language models to AI for data labeling forgeglobal.com. Investor enthusiasm remains sky-high: just this week, AI cybersecurity startup BlinkOps raised $50 million fintech.global, and multiple venture funds are oversubscribed for AI-centric portfolios. For stock investors, pure-play AI equities (like C3.ai, BigBear.ai, and others) have been volatile but mostly climbing, as even relatively small contract wins or product news can spark outsized moves. For instance, BigBear.ai – a tiny defense-focused AI software firm – saw its shares jump after it reaffirmed a 2025 revenue forecast of $160–$180 M (up ~15% YoY) and touted new government project momentum barchart.com finance.yahoo.com. The message: growth investors are eagerly hunting for the “next Nvidia” in the small and mid-cap arena, and any company branding itself with AI can catch a bid. Analysts urge caution on some of these high-flyers (noting many have scant profits), but for now the AI tide is lifting nearly all boats – even previously under-the-radar names.

Defense and Government: Palantir’s Rise and Policy Crosswinds

Palantir: “AI Backbone” of Defense – and Proud of It: One of the biggest winners of the AI-defense nexus is Palantir Technologies. Long known for its secretive data analytics, Palantir has aggressively repositioned as an AI company and is now reaping the rewards. In the first half of 2025, Palantir secured over $1.0 Billion in U.S. government AI contracts, including a landmark $480 M deal to provide an AI targeting system for the Pentagon’s Project Maven (signed in May 2024) and an additional $800 M military investment this spring for battlefield AI capabilities spacedaily.com. CEO Alex Karp has openly embraced a hard-edged, nationalist ethos – a stark contrast to the usual hush-hush approach of Silicon Valley. “We want and need this country to be the strongest, most important country in the world,” Karp declared at a recent client conference, unabashedly positioning Palantir’s technology as a weapon in service of U.S. dominance spacedaily.com spacedaily.com. He even lauded Palantir’s AI in real combat, saying he is “super proud of…what we do to protect our soldiers… to kill our enemies and scare them” with AI-driven targeting spacedaily.com. That blunt language raised some eyebrows, but it resonates with Palantir’s biggest customers in defense and intelligence. The company’s tools have been actively used in Ukraine’s conflict to analyze drone and satellite imagery, pick out targets, and coordinate strikes in real-time – capabilities Karp suggests are “like a drug” to allied militaries hungry for an edge spacedaily.com. Little surprise, then, that Palantir’s stock has more than doubled in 2025 (making it one of the year’s top performers) as investors see it emerging as an AI powerhouse for governments fool.com. It’s now often mentioned in the same breath as Lockheed or Raytheon when discussing defense tech, albeit with a Silicon Valley twist.

Ethical and Legal Scrutiny: Palantir’s rise hasn’t been without controversy. Over a dozen former employees published an open letter in May accusing the company (and other tech giants) of “normalizing authoritarianism under the cover of an AI revolution led by oligarchs.” spacedaily.com They point to Palantir’s work with border agencies (like a $30 M ICE contract for AI-driven deportation tracking spacedaily.com) and a secretive effort, reported by NYTimes and Wired, to build a centralized database of federal government information. Privacy advocates warn that combining disparate data via Palantir’s AI could enable Orwellian surveillance if left unchecked spacedaily.com spacedaily.com. Palantir denies it’s building any “central database on Americans,” insisting its tech is used to fight crime and terror, not spy on ordinary citizens spacedaily.com. Nonetheless, as Palantir becomes the de facto operating system for government AI, regulators and civil liberty groups are paying close attention. So far, the Trump administration (and its AI-friendly “OSTP AI and Crypto czar” David Sacks) have been extremely supportive of Palantir’s role, celebrating its contributions to national security whitehouse.gov whitehouse.gov. But a future administration might impose stricter ethical guidelines on government AI contracts. For now, Palantir’s “America-first” swagger – once an outlier in tech – has gone mainstream, aligning with a broader shift in Washington: viewing AI as a new Cold War domain where the best algorithms win.

White House Launches “AI Action Plan”: In fact, just last week the White House unveiled “Winning the AI Race: America’s AI Action Plan,” a sweeping federal blueprint to cement U.S. leadership in AI whitehouse.gov. Announced on July 23, this plan marshals 90+ policy actions across three pillars: Accelerating Innovation, Building AI Infrastructure, and Leading in Global Security whitehouse.gov. Key provisions include fast-tracking permits for new data centers and chip fabs (to “promote rapid buildout” of AI infrastructure) whitehouse.gov, expanding training programs for high-tech workers like chip engineers and electricians, and removing regulatory barriers that hinder AI development whitehouse.gov. The administration also pledged to streamline export approvals for “secure, full-stack AI packages” to U.S. allies whitehouse.gov – essentially exporting American AI hardware, software, and standards abroad to counter Chinese influence. Notably, the plan insists on “upholding free speech” in AI models: the federal government will only buy from AI vendors who ensure their AI systems are “objective and free from top-down ideological bias,” a pointed shot at concerns over politically-filtered algorithms whitehouse.gov. “America’s AI Action Plan charts a decisive course to cement U.S. dominance in artificial intelligence,” said OSTP Director Michael Kratsios, calling the AI race “non-negotiable” for U.S. economic and military supremacy whitehouse.gov whitehouse.gov. Markets have generally cheered the plan – especially the focus on turbocharging infrastructure. Data-center REITs and construction firms got a modest bump on hopes of faster permitting, and chipmakers (already on a tear) view the pro-AI industrial policy as reinforcing long-term demand nasdaq.com reuters.com. However, some in Congress voiced concern that easing export controls (as seen with Nvidia’s H20) could aid rival powers – expect lively debate on where to strike the balance between global commerce and tech security. Overall, the U.S. government’s stance is clear: more AI, faster – and that’s music to investors’ ears.

China’s AI Drive: Alliances and Innovation Amid Sanctions

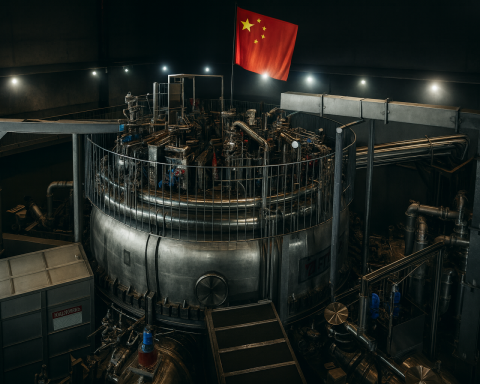

Tech Giants Forge National AI Alliances: Across the Pacific, China spent the week showcasing its own AI firepower. At the World Artificial Intelligence Conference (WAIC) in Shanghai (which concluded July 29), Chinese tech companies unveiled a flurry of initiatives to bolster their domestic AI ecosystem – a direct response to U.S. export restrictions. In a headline announcement, leading AI chipmakers (including Huawei, Biren, Enflame, and Moore Threads) teamed up with top large-model developers (like StepFun and MiniMax) to form the “Model-Chip Ecosystem Innovation Alliance.” The goal of this alliance is to standardize a homegrown AI tech stack – linking hardware and software – so that Chinese AI labs can seamlessly swap in domestic chips for Nvidia’s and still run advanced AI models tomshardware.com tomshardware.com. By agreeing on common frameworks and interfaces, they aim to make models interoperable across multiple Chinese accelerators, reducing dependence on any single foreign architecture tomshardware.com tomshardware.com. “Members will have to seek standardization and interoperability… common protocols between models, chips, and infrastructure,” noted one report, describing how the alliance could enable an AI model to be trained once and run on “any Chinese-made accelerator” with minimal code changes tomshardware.com tomshardware.com. A second consortium launched at WAIC – the Shanghai General Chamber of Commerce AI Committee – brings together firms like SenseTime (China’s facial recognition giant) and Iluvatar CoreX to focus on integrating AI into industrial applications tomshardware.com tomshardware.com. In essence, China is organizing its tech industry to pool resources and accelerate AI self-sufficiency, so it can continue advancing even under U.S. sanctions. Beijing’s message: we will not be slowed down in the AI race. (This coordinated approach also mirrors China’s past efforts in 5G and semiconductors, which eventually yielded Huawei’s dominance in 5G – a parallel not lost on U.S. policymakers.)

Product Breakthroughs at WAIC: The conference wasn’t just bureaucratic alliances – companies also showed off tangible AI innovations. Start-up Zhipu (Z.ai) announced a new open-source language model, GLM-4.5, which it claims can rival cutting-edge Western models at a fraction of the cost silicon.co.uk. Impressively, Zhipu says GLM-4.5 can run on just eight Nvidia H20 GPUs silicon.co.uk – highlighting how Chinese developers are optimizing AI models for the limited high-end chips they can get. (The H20 is the same export-approved Nvidia chip discussed earlier; apparently both U.S. and Chinese firms agree it’s the key to keeping China’s AI training humming under export controls.) Huawei, for its part, unveiled its CloudMatrix 384 AI training cluster, packed with 384 of Huawei’s own Ascend 910C AI chips. According to independent analysts, this system “outperforms Nvidia’s [equivalent] GB200 cluster on some metrics.” silicon.co.uk It’s a significant claim that hints Huawei is closing the gap in AI hardware – exactly what U.S. sanctions tried to prevent. Huawei’s chip division has been working furiously to replace Nvidia silicon, and if these results hold, Chinese cloud providers might increasingly adopt Huawei’s platform to avoid U.S. dependencies silicon.co.uk silicon.co.uk. Also grabbing attention was Tencent’s announcement of Hunyuan 3D World Model 1.0, an open-source generative AI model for creating 3D virtual environments from text or images silicon.co.uk. This tool can rapidly produce interactive 3D scenes (think virtual worlds or game levels) based on simple prompts, showcasing Tencent’s AI research depth. Baidu wowed the crowd with its next-gen “Digital Human” tech: AI that can generate a virtual avatar clone of a real person – complete with the person’s voice and gestures – after analyzing only 10 minutes of sample video silicon.co.uk. Baidu plans to use this for virtual livestreamers and customer service avatars. The demo raised both excitement and a few uneasy questions about deepfakes (Baidu says consent and safeguards are in place). Rounding out the gadget side, Alibaba introduced its prototype Quark AI Glasses, augmented-reality eyewear powered by its Qwen AI model silicon.co.uk. Slated for release in China by year-end, these smart glasses will offer features like AR navigation and even allow users to make payments via Alipay just by looking at a QR code and using voice commands silicon.co.uk. It’s Alibaba’s answer to Meta’s Ray-Ban Stories, integrating a voice assistant and payment system into everyday eyewear. Taken together, the WAIC announcements underscore that Chinese tech firms are rapidly innovating – not just playing catch-up. From open models to specialized hardware and consumer gadgets, China’s AI industry is pressing forward on all fronts, seeking an edge despite U.S. curbs.

Market Impact and Outlook in China: Chinese AI-related stocks have reacted positively to the government’s supportive stance. News of the alliances and domestic breakthroughs helped nudge China’s tech indices higher earlier in the week – the MSCI China IT index hit a 9-month peak before global trade worries trimmed gains marketscreener.com accesswdun.com. Investors see the alliances as a sign Beijing will throw its weight (and funding) behind homegrown AI champions, which could mean subsidies, procurement deals, and regulatory favoritism. For example, shares of Huawei’s suppliers and local GPU startups saw modest bumps on speculation they’ll get a bigger slice of the market. However, the overall Chinese market has been choppy due to macro concerns (property debt issues, U.S.-China tariff jitters, etc.), so AI alone isn’t lifting all boats there the way it has in U.S. markets. Notably, U.S. restrictions still pose a ceiling: Reuters reported that while the Trump administration has approved Nvidia’s H20 sales in principle, the Commerce Department has yet to actually issue export licenses for all orders reuters.com reuters.com. Washington could tighten rules again if it believes chips are being diverted to military uses. And some U.S. lawmakers are indeed alarmed that cutting-edge AI chips (even slightly neutered H20s) are flowing to China, urging stricter enforcement investopedia.com investopedia.com. In response, China’s government this week formed its own Working Group on AI Security to ensure systems like Baidu’s “digital humans” won’t be misused domestically – a sign Beijing wants to preempt any social risks that could give the West an excuse to justify more bans. In summary, China’s AI sector is performing a high-wire act: innovating at breakneck speed and uniting forces internally, all while trying to avoid provocations that could invite harsher sanctions. It’s a delicate balance that markets will be monitoring closely in coming months.

Market Sentiment: Euphoria Tempered by Risks

As July comes to a close, the AI stock frenzy shows few signs of cooling. Every day seems to bring headline-grabbing announcements – record revenues, huge spending plans, new partnerships – that reinforce the narrative of AI transforming the business landscape. This week alone saw multiple stocks pop double-digits on AI news (from Corning’s AI-fiber windfall investopedia.com to small-cap software plays), and the Nasdaq notched yet another record on the back of AI optimism accesswdun.com accesswdun.com. The sector’s leadership is clear: Nvidia, now a $4+ trillion behemoth, has at times been the single biggest factor lifting the S&P 500 accesswdun.com, and megacaps like Alphabet and Microsoft are touching all-time highs largely thanks to their AI stories.

But beneath the exuberance, some investors are growing cautious. The Fed’s ongoing tight monetary policy (with another decision due this week) and the prospect of slower economic growth could eventually test these sky-high valuations. Even Elon Musk’s Tesla – which tried to brand its latest results as an AI play (emphasizing its work on robotaxis and autonomous driving AI) – wasn’t spared, as its stock tumbled 8% after earnings when other concerns (shrinking EV margins, Musk’s controversial public image) took precedence accesswdun.com accesswdun.com. Tesla’s slide was a reminder that however visionary a company’s AI ambitions, fundamentals still matter. Likewise, Intel’s recent earnings underscored challenges in the chip world outside of AI: Intel posted another quarterly loss and warned some of its turnaround plans “may not be fixable” – starkly contrasting with the rosy pictures at AI-focused peers investopedia.com. Intel did tout growing demand for its nascent AI accelerators, but it remains far behind, and its stock has lagged while Nvidia/AMD soar.

Financial experts are advising a “barbell” strategy: participate in the AI upside, but hedge with value stocks or cash in case the AI trade gets overcrowded. There’s recognition that big opportunities (and threats) lie ahead. On one hand, AI could unlock entirely new markets – Citi now predicts “sovereign AI” investments by governments will add tens of billions in chip demand investopedia.com, and HSBC sees autonomy (robotaxis, etc.) as a $40 billion market in China alone within a few years silicon.co.uk. On the other hand, the regulatory environment is only just taking shape. Europe’s AI Act is set to kick in next year (with new guidelines for generative AI issued July 18) and will impose compliance costs on many AI software companies digital-strategy.ec.europa.eu digital-strategy.ec.europa.eu. In the U.S., rumblings continue about antitrust in big tech (AI could strengthen the giants’ moats, drawing scrutiny) and about liability for AI-driven mistakes or biases. Any high-profile AI failure – say, an autonomous vehicle crash or a misuse of AI in finance – could tap the brakes on the hype. For now, though, the market’s tone is best captured by a note from one top tech analyst who quipped, “The AI boom isn’t over – in fact, it’s just getting started.” Indeed, Wall Street’s consensus on AI leaders remains overwhelmingly positive, with an example being Nvidia’s analyst roster showing 34 “Buy” ratings to only 1 “Sell” fingerlakes1.com. Bulls argue that we are in the early innings of a multi-year AI investment cycle, comparable to the dawn of the internet – and that short-term gyrations or talk of “bubbles” won’t derail what is fundamentally a paradigm shift across industries.

Bottom Line: The last two days (July 29–30, 2025) encapsulated the extremes of the AI stock mania – euphoric highs powered by blowout earnings, huge spending commitments, and product breakthroughs, tempered by undercurrents of caution from regulators and a few dissenting analysts. It’s a market intelligence snapshot of an economy in transformation: companies old and new are reinventing themselves around AI, investors are rewarding virtually anything AI-related, and governments are racing to lay the groundwork (and rules) for an AI-powered future. Seasoned market watchers advise keeping one eye on the dazzling growth and the other on possible speed bumps (policy shifts, competition, or simply gravity on valuations). But for now, the narrative driving stocks is clear – AI is the engine of growth in tech, and everyone wants a piece of the action. In the words of one venture capitalist, “This is a gold rush. Picks and shovels, or gold itself – either way, the winners will be those who enable the AI age.” And judging by the headlines through July’s end, the rush is only accelerating – with fortunes (and perhaps upheavals) being made in real time as the AI revolution unfolds.

Sources: Major financial news outlets and company reports (Bloomberg, Reuters, AP, Investopedia, TechCrunch) covering AI stock developments on July 29–30, 2025, including earnings releases, analyst commentary, and government announcements nasdaq.com reuters.com whitehouse.gov investopedia.com reuters.com investopedia.com tomshardware.com accesswdun.com.