Fuel cells have emerged from the lab to center stage in the clean energy revolution. In 2025, hydrogen-fueled power is gaining unprecedented momentum across industries. These devices generate electricity electrochemically—often using hydrogen—with zero tailpipe emissions (only water vapor) and high efficiency. All major economies now see fuel cells as vital for decarbonizing sectors that batteries and grid power struggle to reach. Governments are rolling out hydrogen strategies, companies are investing billions in R&D and infrastructure, and fuel cell vehicles and power systems are hitting the market in ever-growing numbers. This report provides an in-depth look at today’s fuel cell landscape, covering the major fuel cell types and their applications in transportation, stationary power generation, and portable devices. We review recent technological innovations that are improving performance and cutting costs, assess the environmental impact and economic feasibility of fuel cells, and survey the latest market trends, policies, and industry developments worldwide. Perspectives from scientists, engineers, and industry leaders are included to highlight both the excitement and the challenges on the road ahead.

Fuel cells are not a new idea – early alkaline units helped power the Apollo spacecraft – but they are now finally poised for mainstream adoption. As Dr. Sunita Satyapal, longtime U.S. Department of Energy hydrogen program director, observed in a 2025 interview: government-backed R&D has enabled over “1000 US patents… including catalysts, membranes, and electrolysers,” and led to tangible successes like “about 70,000 commercial hydrogen fuel cell forklifts in operation at major companies such as Amazon and Walmart”, proving that targeted funding “can foster market breakthroughs.” innovationnewsnetwork.com Today’s fuel cells are more efficient, durable and affordable than ever, yet hurdles remain. Cost, hydrogen infrastructure, and durability are still “one of the greatest challenges” according to Satyapal innovationnewsnetwork.com, and skeptics point out that progress has sometimes lagged hype. Nonetheless, with robust support and innovation, the fuel cell industry is experiencing significant growth and optimism, laying the groundwork for a hydrogen-fueled future. In the words of Toyota’s hydrogen chief engineer, “This has not been an easy road, but it is the right road.” pressroom.toyota.com

(In the sections below, we’ll explore all facets of the fuel cell revolution, with up-to-date data and quotes from experts around the world.)

Major Types of Fuel Cells

Fuel cells come in several types, each with unique electrolytes, operating temperatures, and best-suited applications energy.gov. The major categories include:

- Proton Exchange Membrane Fuel Cells (PEMFC) – Also called polymer electrolyte membrane fuel cells, PEMFCs use a solid polymer membrane as electrolyte and a platinum-based catalyst. They run at relatively low temperatures (~80°C), allowing quick start-up and high power density energy.gov. PEM fuel cells require pure hydrogen (and oxygen from air) and are sensitive to impurities like carbon monoxide energy.gov. Their compact, lightweight design makes them ideal for vehicles – indeed PEMFCs power most hydrogen cars, buses and trucks today energy.gov. Automakers have spent decades improving PEM technology, reducing platinum loadings and increasing durability.

- Solid Oxide Fuel Cells (SOFC) – SOFCs use a hard ceramic electrolyte and operate at very high temperatures (600–1,000°C) energy.gov. This allows internal reforming of fuels – they can run on hydrogen, biogas, natural gas or even carbon monoxide, converting these fuels to hydrogen internally energy.gov. SOFCs can reach ~60% electrical efficiency (and >85% in combined heat-and-power mode) energy.gov. They don’t need precious metal catalysts due to the high operating temperature energy.gov. However, the extreme heat means slow startup and materials challenges (thermal stress and corrosion) energy.gov. SOFCs are primarily used in stationary power (from 1 kW units up to multi-MW power plants) where their fuel flexibility and efficiency are huge assets. Companies like Bloom Energy have deployed SOFC systems for data centers and utilities, and Japan has tens of thousands of small SOFCs in homes for combined heat and power.

- Phosphoric Acid Fuel Cells (PAFC) – PAFCs use liquid phosphoric acid as the electrolyte and typically a platinum catalyst. They are an older, “first generation” fuel cell technology that became the first to see commercial stationary use energy.gov. PAFCs run at ~150–200°C and are more tolerant of impure hydrogen (e.g. reformed from natural gas) than PEMFCs energy.gov. They have been used in stationary applications like onsite generators for hospitals and office buildings, and even in some early bus trials energy.gov. PAFCs can reach ~40% electrical efficiency (up to 85% in co-generation) energy.gov. Downsides are their large size, heavy weight, and high platinum loading which makes them costly energy.gov. Today PAFCs are still manufactured by firms like Doosan for stationary power, though they face competition from newer types.

- Alkaline Fuel Cells (AFC) – Among the first fuel cells developed (used by NASA in the 1960s), AFCs use an alkaline electrolyte such as potassium hydroxide. They have high performance and efficiency (over 60% in space applications) energy.gov. However, traditional liquid-electrolyte AFCs are extremely sensitive to carbon dioxide – even CO₂ in air can degrade performance by forming carbonates energy.gov. This historically limited AFCs to closed environments (like spacecraft) or required scrubbed oxygen. Modern developments include alkaline membrane fuel cells (AMFCs) that use a polymer membrane, reducing CO₂ sensitivity energy.gov. AFCs can use non-precious metal catalysts, making them potentially cheaper. Companies are revisiting alkaline technology for certain uses (for example, UK-based AFC Energy is deploying alkaline systems for off-grid power and EV charging). Challenges remain around CO₂ tolerance, membrane durability, and shorter lifetimes compared to PEM energy.gov. AFCs today find niche applications, but ongoing R&D could make them viable in the small-to-medium power range (watts to kilowatts).

- Molten Carbonate Fuel Cells (MCFC) – MCFCs are high-temperature fuel cells (operating ~650°C) that use a molten carbonate salt electrolyte suspended in a ceramic matrix energy.gov. They are intended for large stationary power plants running on natural gas or biogas – for example, utility power generation or industrial cogeneration. MCFCs can use nickel catalysts (no platinum) and internally reform hydrocarbons to hydrogen at operating temperature energy.gov. This means MCFC systems can directly feed on fuels like natural gas, generating hydrogen in-situ and thus simplifying the system (no external reformer needed) energy.gov. Their electrical efficiency can approach 60–65%, and with combined use of waste heat they can exceed 85% efficiency energy.gov. The biggest drawback is durability: the hot, corrosive carbonate electrolyte and high temperature accelerate component degradation, limiting life to around 5 years (~40,000 hours) in current designs energy.gov. Researchers are seeking more corrosion-resistant materials and designs to extend life. MCFCs have been deployed in hundred-megawatt-scale in South Korea (one of the world leaders in stationary fuel cells, with over 1 GW of fuel cell power installed as of mid-2020s) fuelcellsworks.com. In the U.S., companies like FuelCell Energy offer MCFC power plants for utilities and large facilities, often in partnership with natural gas providers.

- Direct Methanol Fuel Cells (DMFC) – A subset of PEM fuel cell technology, DMFCs oxidize liquid methanol (usually mixed with water) directly at the fuel cell anode energy.gov. They produce CO₂ as a byproduct (since methanol contains carbon), but offer a convenient liquid fuel that is easier to handle than hydrogen. Methanol’s energy density is higher than compressed hydrogen (though lower than gasoline) and it can leverage existing fuel logistics energy.gov. DMFCs are typically low-power units (tens of watts to a few kW) used in portable and remote applications: for example, off-grid battery chargers, military portable power packs, or small mobility devices. Unlike hydrogen PEMFCs, DMFCs don’t need high-pressure tanks – fuel can be carried in lightweight bottles. However, DMFC systems have lower efficiency and power density, and the catalyst can be poisoned by intermediate reaction products. They also still use precious metal catalysts. DMFCs saw interest for consumer electronics in the 2000s (prototype fuel cell phones and laptops), but modern lithium batteries largely beat them out in that arena. Today, DMFCs and similar portable fuel cells are used where long-endurance off-grid power is needed without relying on heavy batteries or generators – e.g. by the military and in remote environmental sensors. The DMFC market remains relatively small (hundreds of millions of USD globally imarcgroup.com), but steady advances are being made to improve methanol fuel cell performance and durability techxplore.com.

Each fuel cell type has advantages suited to particular use cases – from fast-start car engines (PEMFC) to megawatt-scale power plants (MCFC and SOFC). Table 1 below summarizes the key characteristics and typical uses:

(Table 1: Comparison of Major Fuel Cell Types – PEMFC, SOFC, PAFC, AFC, MCFC, DMFC) energy.gov

| Fuel Cell Type | Electrolyte & Temp | Key Applications | Pros | Cons |

|---|---|---|---|---|

| PEMFC | Polymer membrane; ~80°C | Vehicles (cars, buses, forklifts); some stationary and portable applications | High power density; quick start; compact energy.gov | Requires pure H₂ and platinum catalyst; sensitive to impurities energy.gov. |

| SOFC | Ceramic oxide; 600–1000°C | Stationary power (micro-CHP, large plants); potential for ships, range extenders | Fuel flexible (can use natural gas, biogas); very efficient (60%+); no precious metals needed energy.gov. | Slow startup; high-temp materials challenges; needs insulation and thermal cycling management energy.gov. |

| PAFC | Liquid phosphoric acid; ~200°C | Stationary CHP units (200 kW-class); early bus demos | Mature technology; tolerant of reformed fuel (some CO present) energy.gov; good CHP efficiency (85% with heat use). | Large and heavy; high platinum loading (costly) energy.gov; ~40% elec. efficiency; gradual decline in use. |

| AFC | Alkaline (KOH or membrane); ~70°C | Space applications; niche portable and backup systems | High efficiency and performance (in CO₂-free environments) energy.gov; can use non-precious catalysts. | CO₂ intolerant (except improved AMFC versions) energy.gov; traditional designs require pure O₂; newer membrane types still improving durability energy.gov. |

| MCFC | Molten carbonate; ~650°C | Utility-scale power plants; industrial CHP (hundreds of kW to multi-MW) | Fuel flexible (internal reforming of CH₄); high efficiency (~65% elec.) energy.gov; uses cheap catalysts (nickel). | Short lifespan (~5 years) due to corrosion energy.gov; very high operating temp; only for large stationary use (not suitable for vehicles). |

| DMFC | Polymer membrane (methanol-fed); ~60–120°C | Portable generators; military battery replacement; small mobility devices | Uses liquid methanol fuel (easy transport, high energy density vs H₂) energy.gov; simple refueling. | Lower power and efficiency; emits some CO₂; methanol crossover and catalyst poisoning issues. |

(Note: Other specialized fuel cell types exist, such as Regenerative/ Reversible Fuel Cells that can run in reverse as electrolyzers, or Microbial Fuel Cells that use bacteria to generate power, but these are beyond the scope of this report. We focus on the major commercial/research categories above.)

Fuel Cells in Transportation

Perhaps the most visible use of fuel cells is in transportation. Hydrogen Fuel Cell Electric Vehicles (FCEVs) complement battery EVs by offering fast refueling and long driving range with zero tailpipe emissions. In 2025, fuel cell buses, trucks, cars and even trains are being deployed in growing numbers, especially for use cases where batteries’ weight or charging time is problematic. As a coalition of 30+ industry CEOs noted in a joint letter to EU leaders, “hydrogen technologies are vital to ensuring a diversified, resilient, and cost-effective decarbonisation of road transport,” arguing that a dual-track approach with both batteries and fuel cells “will be cheaper for Europe than relying on just electrification.” hydrogen-central.com

Fuel Cell Cars and SUVs

Passenger FCEVs like the Toyota Mirai and Hyundai Nexo have been on the market for a few years. These use PEM fuel cell stacks to power electric motors, similar to battery EVs but refueled with hydrogen gas in 3-5 minutes. Toyota, Hyundai, and Honda have collectively put tens of thousands of fuel cell cars on the road globally (albeit still a niche compared to battery EVs). As of 2025, the global FCEV market is valued around $3 billion, projected to grow over 20% annually globenewswire.com. Consumer uptake has been strongest in regions with hydrogen fueling infrastructure: California (USA), Japan, South Korea, and a few countries in Europe (Germany, UK, etc.). For instance, Germany now has over 100 hydrogen refueling stations operational nationwide globenewswire.com, and Japan has around 160 stations, making these countries prime markets for FCEVs. France launched a €7 billion national hydrogen plan that includes deploying hydrogen-powered buses and light commercial vehicles for government and public transit use globenewswire.com.

Automakers remain committed to fuel cell tech as part of a multi-pathway strategy. Toyota in 2025 outlined a broad roadmap for a “hydrogen-powered society,” expanding fuel cells beyond the Mirai sedan into heavy trucks, buses, and even stationary generators pressroom.toyota.com. “Many of Toyota’s efforts toward decarbonization have focused on battery electrics, but hydrogen fuel cell powertrains remain an important part of our multi-pathway strategy,” the company affirmed pressroom.toyota.com. Toyota’s approach includes collaborative standards-setting: “We are collaborating with companies that would traditionally have been our competition to develop standards for hydrogen fueling… recognizing that an industry standard was of greater benefit than our own competitive advantage,” said Jay Sackett, Toyota’s Chief Engineer of Advanced Mobility pressroom.toyota.com. This industry cooperation aims to ensure uniform fueling protocols and safety practices, which in turn can accelerate adoption.

In terms of performance, the latest fuel cell cars match conventional vehicles. The Hyundai NEXO SUV (2025 model) claims over 700 km range per hydrogen fill globenewswire.com. These vehicles emit no pollutants, and their only by-product is water – a Mirai famously dripped water on the road to prove the point. Automakers are working to reduce costs: the Mirai’s second-generation model came down in price, and Chinese manufacturers are also entering with lower-cost models (often with government subsidies). Still, fueling infrastructure remains a chicken-and-egg challenge for consumer FCEVs – as of 2025 there are roughly 1,000 hydrogen stations globally, which is minuscule compared to gas stations or EV charging points. Many countries are funding station buildout; e.g. Germany’s H2 Mobility initiative targets a nationwide hydrogen highway network, and California’s state programs are subsidizing dozens of stations to support 10,000+ FCEVs.

Buses and Public Transit

Transit buses have been a major early focus for fuel cells. Buses return to depots (simplifying fueling) and run long hours, which suits fuel cells’ quick refuel and long range. In Europe, there were 370 fuel cell buses in operation by January 2023, with plans for over 1,200 by 2025 sustainable-bus.com. This scale-up is aided by EU funding programs (like JIVE and Clean Hydrogen Partnership projects) that help cities procure hydrogen buses. Progress is visible: Europe saw 426% year-on-year growth in H₂ bus registrations in the first half of 2025 (279 units in H1 2025 vs 53 in H1 2024) sustainable-bus.com. These buses typically use PEM fuel cell systems (from providers like Ballard Power Systems, Toyota, or Cummins) coupled with battery hybrids. They offer ranges of 300-400 km per fill and avoid the weight and range limitations that battery-electric buses face on longer routes or colder climates.

Cities like London, Tokyo, Seoul, and Los Angeles have all put hydrogen buses into service. Vienna, for example, chose hydrogen buses for certain city center routes to avoid installing charging gear downtown; by using H₂ buses they “no longer require charging infrastructure in the city centre and could reduce the fleet size (hydrogen buses cover routes with fewer vehicles due to fast refueling and longer range)”, the transit operator noted sustainable-bus.com. Real-world performance has been encouraging – transit agencies report that fuel cell buses achieve availability and refueling times comparable to diesel, with water vapor exhaust that improves air quality. The main drawback remains cost: a fuel cell bus can cost 1.5–2× a diesel bus. However, large orders and new models are bringing prices down. In 2023, Bologna, Italy ordered 130 hydrogen buses (Solaris Urbino models) – the largest single H₂ bus tender to date sustainable-bus.com, signaling confidence in scaling up. China, notably, already has thousands of fuel cell buses on the road (Shanghai and other cities rolled them out for urban routes and for the 2022 Winter Olympics). In fact, China accounts for over 90% of global FCEV buses and is rapidly deploying hydrogen transit and logistics vehicles with strong state support globenewswire.com.

Industry experts believe fuel cells will dominate long-distance coaches and heavy transit. “Hydrogen fuel cell technology is gaining ground as the preferred option for the ‘post-diesel’ future in long-haul operations,” writes Sustainable Bus magazine, citing multiple projects to develop fuel cell coaches for intercity travel sustainable-bus.com. For example, FlixBus (a major European coach operator) is piloting a fuel cell coach with a 450+ km range target sustainable-bus.com. Manufacturers like Van Hool and Caetano are also developing H₂ coaches. The heavy-duty usage demands improved durability: current fuel cell stacks from passenger cars last ~5,000–8,000 hours, but a coach or truck needs ~30,000+ hours. Freudenberg, developing fuel cells for buses, has “a dedicated heavy-duty design targeting a minimum lifetime of 35,000 hours,” reflecting the order-of-magnitude jump in durability needed for commercial fleets sustainable-bus.com. This is one of the engineering challenges being overcome to ensure fuel cells meet the rigorous duty cycles of public transit and freight.

Trucks and Heavy-Duty Transport

Heavy-duty trucks are seen as one of the most promising and necessary applications for fuel cells. These vehicles require long range, fast refueling, and high payload capacity – areas where batteries struggle due to weight and charging times. Fuel cell trucks can be refueled in 10–20 minutes and carry enough hydrogen for 500+ km of range, all while maintaining payload (since hydrogen tanks are lighter than massive battery packs for equivalent energy). Major truck-makers have programs: Daimler Truck and Volvo created a joint venture (cellcentric) to produce fuel cell systems for trucks, targeting mass production later this decade. Nikola, Hyundai, Toyota, Hyzon, and others have prototype or early commercial fuel cell semi-trucks on the road in 2025. Europe’s Hydrogen Mobility Alliance stated unequivocally that “Heavy-Duty Long-Haul Trucking is the prime hydrogen automotive use case and heavy-duty fuel cell systems are the core technology” needed hydrogen-central.com. This sentiment is echoed by the CEO of Daimler Truck, Karin Rådström, who said “Hydrogen trucks are the perfect complement to battery-electric ones — offering long ranges, fast refueling, and a big opportunity for Europe. We lead in hydrogen tech, and we’ll stay ahead if we act now — across the full value chain.” hydrogen-central.com Her point underlines that European manufacturers have invested heavily in fuel cell know-how (Daimler began fuel cell R&D in the 1990s) and don’t intend to cede leadership, but they urge policymakers to build hydrogen truck infrastructure now to capitalize on that lead.

Real-world trials are validating the concept. Hyundai deployed a fleet of 47 fuel cell heavy trucks in Switzerland starting in 2020 (the XCIENT model) and by 2025 these trucks collectively logged over 4 million km of operation. Building on that, Hyundai’s Vice Chair Jaehoon Chang announced their H₂ trucks in Europe have “collectively driven over 15 million kilometers… demonstrating both the reliability and scalability of hydrogen in commercial logistics.” hydrogen-central.com This is a powerful proof point that fuel cell trucks can handle intense daily use. In North America, startup Nikola has delivered fuel cell semi-trucks to early customers (though the company faced financial hurdles and a 2023 restructuring h2-view.com). Toyota has built hydrogen fuel cell Class-8 trucks (using Mirai-based fuel cell stacks) for drayage at the Los Angeles ports, where a fleet of around 30 H₂ trucks hauls freight with fueling provided by a dedicated hydrogen “Tri-Gen” plant at Long Beach pressroom.toyota.com. That plant, built with FuelCell Energy, converts renewable biogas into hydrogen, electricity, and water on-site – yielding 2.3 MW of power plus up to 1,200 kg of hydrogen per day pressroom.toyota.com. The hydrogen fuels both the Toyota trucks and passenger FCEVs, while the electricity runs port operations and even the byproduct water is used to wash cars offloaded from ships pressroom.toyota.com. Toyota highlighted that this system alone “offsets 9,000 tons of CO₂ emissions per year” at the port, replacing what diesel trucks would have emitted pressroom.toyota.com. “There are as many as 20,000 opportunities every day to clean up the air with hydrogen fuel cell-powered trucks,” Toyota’s Jay Sackett noted, referring to the daily trips of diesel trucks at the LA/Long Beach ports that could be replaced pressroom.toyota.com.

Hydrogen fueling for trucks is getting a boost via partnerships. In the EU, companies launched the H2Accelerate initiative to synchronize the rollout of hydrogen freight corridors and refueling stations for long-haul trucks in the late 2020s. California’s Energy Commission is funding several high-capacity hydrogen truck stations (capable of fueling dozens of trucks per day) to support drayage and eventually long-haul routes to inland logistics hubs. China’s government is aggressively promoting fuel cell trucks in select provinces with subsidies and mandates, aiming for 50,000 fuel cell vehicles on the road by 2025 and 100,000–200,000 by 2030 along with 1,000 H₂ stations globenewswire.com. Already, China has put heavy fuel cell trucks into steel factory operations and mining, leveraging domestic tech (companies like Weichai and REFIRE provide fuel cell systems).

Trains, Ships and Aircraft

Beyond road vehicles, fuel cells are finding a role in other transportation modes:

- Trains: Several hydrogen fuel cell passenger trains are now in service, a major milestone for rail decarbonization. Notably, Alstom’s Coradia iLint fuel cell train entered commercial service in Germany in 2018 and by 2022 was running on regional lines in Lower Saxony, replacing diesel trains. In 2022, a fleet of 14 Alstom fuel cell trains began operation in Frankfurt region, and pilot projects are underway in Italy, France, and the UK. These trains carry hydrogen onboard in tanks and can run 1000 km+ per fill, suitable for non-electrified lines (about half of Europe’s rail network is unelectrified). Fuel cell trains eliminate the need for costly overhead electric lines on low-traffic routes. As of 2025, Europe has committed to expanding hydrogen trains: for example, Italy ordered 6 fuel cell trains for Lombardy, France is testing Alstom units, and the UK trialed a HydroFLEX train. In the US, development is slower but companies like Stadler are supplying a hydrogen train for California. China also unveiled a prototype hydrogen locomotive in 2021. For freight, mining company Anglo American debuted a 2MW fuel cell hybrid locomotive in 2022. In sum, fuel cells are proving their worth for rail lines where batteries would be too heavy or have insufficient range.

- Marine (Ships and Boats): The maritime sector is exploring fuel cells for both auxiliary and primary power. Small passenger ferries and vessels have been early adopters. In 2021, the MF Hydra in Norway became the world’s first liquid hydrogen fuel cell ferry, carrying cars and passengers with a 1.36 MW Ballard fuel cell system. Japan tested a fuel cell ferry (the HydroBingo) and is eyeing hydrogen for coastal shipping. The European Union is funding projects like H2Ports and FLAGSHIPS to demonstrate H₂ vessels and hydrogen bunkering at ports. For larger ships, the current consensus is to use fuel cells with hydrogen-derived fuels like ammonia or methanol (which can be “cracked” or used in fuel cells with the right design). For example, Norway’s cruise operator Hurtigruten is developing a cruise ship with SOFCs running on green ammonia by 2026. Another niche is underwater vehicles and submarines: fuel cells (especially PEM) can provide silent, air-independent power – Germany’s Type 212A submarines use hydrogen fuel cells for stealthy operation. While long-haul container ships will likely rely on combustion engines burning ammonia or methanol in the near-term, fuel cells could complement them for port maneuvers or eventually scale up as high-power fuel cells (several MW) are developed. As safety and storage issues are worked out, fuel cells offer ships the promise of zero-emission propulsion without the noise and vibration of diesel engines.

- Aviation: Aviation is the toughest sector to decarbonize, and hydrogen fuel cells are being actively researched for certain niches. Fuel cells are unlikely to ever power a jumbo jet directly (hydrogen combustion or other fuels might do that), but they have potential in smaller aircraft or as part of hybrid systems. Several startups (ZeroAvia, Universal Hydrogen, H2Fly) have flown small planes retrofitted with hydrogen fuel cells driving propellers. In 2023, ZeroAvia flew a 19-seat test plane (a Dornier 228) with one of its two engines replaced by a fuel cell-electric powertrain. Their next goal is 40-80 seat regional aircraft on hydrogen by 2027. Airbus, the world’s largest airliner maker, initially studied hydrogen combustion turbines but in 2023 announced a shift of focus to “a fully electric, hydrogen-powered aircraft with a fuel cell engine” as the primary route for its ZEROe program airbus.com. In June 2025, Airbus signed a major partnership with engine manufacturer MTU Aero Engines to develop and mature fuel cell propulsion for aviation. “Our focus on fully electric fuel cell propulsion for future hydrogen-powered aircraft underscores our confidence and progress in this domain,” said Bruno Fichefeux, Airbus Head of Future Programs airbus.com. “Collaborating with MTU… will allow us to pool our knowledge, accelerate maturation of critical technologies, and ultimately deliver a revolutionary hydrogen-powered propulsion system for future commercial aircraft. Together, we are actively pioneering it.” airbus.com Similarly, MTU’s Dr. Stefan Weber emphasized their “vision of a revolutionary propulsion concept that allows virtually emissions-free flight,” calling the joint effort a key step toward making fuel cell-powered airliners a reality airbus.com. This partnership sketches a multi-year roadmap: first improving components (high-power fuel cell stacks, cryogenic H₂ storage, etc.), then ground-testing a full-scale fuel cell powertrain, with the aim of a certifiable aviation fuel cell engine in the 2030s airbus.com. The target application is likely a small regional aircraft initially, but scaling up to single-aisle short-haul planes is the ultimate prize. Fuel cells produce only water and have the advantage of high efficiency at cruise altitudes. Challenges include weight (fuel cells and motors vs. turbofan engines) and storing enough hydrogen (likely as liquid hydrogen) on the aircraft. Airbus’ public commitment indicates strong belief that these challenges can be solved. Meanwhile, fuel cells are also being used on aircraft in other ways: as APUs (auxiliary power units) to provide on-board electricity quietly, and even to generate water for crew (regenerative fuel cells). NASA and others have studied using regenerative fuel cells as energy storage for electric aircraft. Overall, while hydrogen aircraft are at an early stage, the late 2020s will likely see the first commercial routes served by fuel cell-powered planes, especially as companies like Airbus, MTU, Boeing, and Universal Hydrogen intensify R&D and prototype testing.

- Drones and Specialty Vehicles: A smaller but growing category is fuel cell drones and specialty vehicles. Companies like Intelligent Energy and Doosan Mobility have developed PEM fuel cell power packs for drones, enabling much longer flight times than lithium batteries. Hydrogen drone kits can keep UAVs flying for 2–3 hours vs 20-30 minutes on batteries, which is valuable for surveillance, mapping, or delivery applications. In 2025, South Korea even demonstrated a hydrogen fuel cell multi-copter drone carrying 5 kg payload for over an hour. On the ground, fuel cells also power forklifts (as mentioned earlier) and airport equipment (tow tractors, refrigerated trucks) where battery swapping is cumbersome. The material handling sector has quietly become a fuel cell success story: over 70,000 fuel cell forklifts are now in daily use in warehouses innovationnewsnetwork.com, benefitting companies by “zero emissions in warehouse environments” and higher productivity (no battery charging downtime). Major retailers like Walmart and Amazon invested heavily in these through vendors like Plug Power. This early adoption underscores that fuel cells can find niches where their unique advantages (fast refuel, continuous power) beat batteries or engines.

In summary, fuel cells are making inroads across transportation: from passenger cars to the largest vehicles, and even into the skies. Heavy-duty transport is a clear sweet spot – experts widely agree hydrogen fuel cells will play a “vital role in decarbonising transport, particularly in sectors where battery-electric options may not suffice” hydrogen-central.com. The coming years will determine the extent; much depends on building sufficient hydrogen fueling infrastructure and achieving economies of scale to lower vehicle costs. But the presence of fuel cell vehicles in public fleets, freight operations, and niche uses is already helping drive hydrogen demand and normalize the technology. As Oliver Zipse, BMW’s CEO, put it: “In today’s context, hydrogen is not just a climate solution – it’s a resilience enabler. … At BMW, we know there is no full decarbonisation or competitive European mobility sector without hydrogen.” hydrogen-central.com

Stationary Power Generation with Fuel Cells

While hydrogen cars grab headlines, stationary fuel cell systems are quietly transforming how we generate and use power. Fuel cells can provide clean, efficient electricity and heat for homes, buildings, data centers, and even feed into the grid. They offer an alternative to combustion generators (and the associated emissions/noise), and can firm up renewable-heavy power grids with on-demand, dispatchable power. Key stationary applications include:

- Backup Power and Remote Power – Telecom towers, data centers, hospitals, and military installations require reliable backup power. Traditionally diesel generators fill this role, but fuel cell alternatives (running on hydrogen or liquid fuels) are increasingly popular for zero-emission backup. For example, Verizon and AT&T have deployed hydrogen fuel cell backups at cell towers to extend runtime beyond battery UPS systems. In 2024, Microsoft announced it had successfully tested a 3 MW fuel cell generator to replace diesel gensets for data center backup, running off hydrogen produced on-site carboncredits.com. Fuel cells start instantaneously and have minimal maintenance compared to engines. Plus, in indoor facilities (or urban areas), emission-free operation is a huge plus – no CO₂, NOx or particulate pollution. The U.S. and European telecommunications industries have begun implementing fuel cells especially where noise or environmental regulations restrict diesel use. Even smaller-scale, portable fuel cell generators (like ones by SFC Energy or GenCell) can provide remote power for military outposts or disaster relief operations. A U.S. Army project, for instance, uses a “H2Rescue” truck equipped with a fuel cell generator for disaster zones – it can provide 25 kW of power for 72 hours straight and recently set a world record by driving 1,806 miles on a single hydrogen fill innovationnewsnetwork.com. Such capabilities are attracting emergency agencies to consider fuel cells for resilient backup power.

- Residential and Commercial Micro-CHP – In Japan and South Korea, tens of thousands of homes are equipped with micro combined heat and power (CHP) fuel cell units. Japan’s long-running Ene-Farm program (supported by Panasonic, Toshiba, etc.) has deployed over 400,000 PEMFC and SOFC home units since 2009. These units (~0.5–1 kW electric) generate electricity for the home and their waste heat is used for hot water or space heating, reaching overall efficiency of 80–90%. They typically run on hydrogen derived from natural gas via a small reformer. By generating power on-site, they reduce grid load and carbon footprint (especially if coupled with renewable-sourced gas). South Korea similarly has incentives for residential fuel cells. Europe and the US have trial projects (e.g. Fuel Cell micro-CHP units in Germany under the KfW program), but adoption is slower due to high upfront costs and lower natural gas prices historically. However, as natural gas heating is phased out for climate reasons, fuel cell CHP could see a niche for efficient home energy, especially if fueled by green hydrogen or biogas.

- Primary Power and Utility-Scale Fuel Cell Plants – Fuel cells can be aggregated into megawatt-scale power plants feeding into the electric grid or powering factories/hospitals/university campuses. The advantages include high efficiency, extremely low emissions (especially if using hydrogen or biogas), and a small footprint compared to other power plants. For instance, a 59 MW fuel cell park in Hwasung, South Korea (using POSCO Energy MCFC units) has been delivering power to the grid for years researchgate.net. South Korea is the world leader here: it has over 1 GW of stationary fuel cell capacity installed, supplying distributed power in cities and industrial sites fuelcellsworks.com. One driver is Korea’s renewable targets – fuel cells qualify as clean energy under certain regulations there, and they also improve local air quality by displacing coal/diesel generators. In the US, companies like Bloom Energy (with SOFC systems) and FuelCell Energy (with MCFC systems) have built projects from 1 MW up to ~20 MW for utilities and large corporate campuses. In 2022, Bloom and SK E&S inaugurated an 80 MW Bloom SOFC installation in South Korea – the world’s largest fuel cell array bloomenergy.com. Notably, these systems can load-follow and some can provide combined heat (useful for district heating or industrial steam). In Europe, fuel cell power plants are fewer but growing – Germany, Italy, and the UK have seen installations in the single-digit MW range, often using PEM or SOFC units feeding biogas. In 2025, Norway’s Statkraft had planned a 40 MW hydrogen fuel cell power plant (to buffer renewables), though it paused some new H₂ projects due to cost concerns ts2.tech. The trend is that fuel cells are becoming part of the distributed energy resource mix, providing reliable power with less pollution. They complement intermittent renewables as well; for example, a fuel cell can use hydrogen produced from surplus solar/wind (either directly or via a connected electrolyzer) and then run when renewable output is low, effectively acting as energy storage. This concept of “Power-to-Hydrogen-to-Power” is being tested in microgrids. The U.S. National Renewable Energy Lab installed a 1 MW PEM fuel cell system (from Toyota) at its campus in Colorado in 2024 for research on using fuel cells to enhance energy resilience and integrate with solar/storage pressroom.toyota.com.

- Industrial and Commercial CHP – Beyond homes, larger fuel cell CHP systems are used in hospitals, universities, and corporate facilities. A 1.4 MW PAFC plant might power a hospital with its waste heat providing steam, achieving overall efficiency above 80%. Universities like Yale and Cal State have operated multi-MW fuel cell plants (FuelCell Energy MCFC units) on campus, cutting their grid draw and emissions. Businesses such as IBM, Apple, and eBay have installed fuel cell farms at data centers (e.g. Apple had a 10 MW Bloom Energy fuel cell farm in North Carolina, primarily biogas-fueled). These not only supply clean power on-site but also act as backup and grid support. Governments encourage such projects via incentives; in the US, the federal Investment Tax Credit (ITC) for fuel cells (30% credit) was renewed through at least 2025 fuelcellenergy.com, and states like California provide additional credits through SGIP. In Europe, some countries allow co-generation fuel cell units to earn feed-in tariffs or grants. As a result, stationary fuel cell installations are on track for a record-breaking year in 2023–2024 with ~400 MW added annually and projections of over 1 GW per year globally by the 2030s fuelcellsworks.com. This is still small in the power sector context, but growth is accelerating.

- Grid Balancing and Power Storage – A novel application of fuel cells is balancing renewable-heavy grids. Regions with lots of solar/wind are investigating hydrogen energy storage: when excess power is available, use it to electrolyze water into hydrogen; then store and later feed the hydrogen to fuel cells to regenerate electricity at times of high demand or low renewable output. Fuel cells in this mode essentially act as highly responsive, zero-emission peaker plants. For example, a project in Utah, USA (Intermountain Power) is planning hundreds of MW of reversible solid oxide fuel cells by 2030 that can switch between electrolysis and power generation, helping Los Angeles achieve 100% clean energy by storing energy in hydrogen caverns. European utilities are similarly testing smaller pilot systems. While battery storage typically handles short-duration balancing (hours), hydrogen + fuel cells could cover multi-day or seasonal gaps, which is essential for full grid decarbonization. The U.S. Department of Energy’s Hydrogen Earthshot aims to make such long-duration storage economic by cutting hydrogen costs. Dr. Sunita Satyapal noted “hydrogen can be one of the few options for storing energy over weeks or months”, enabling deeper renewable integration iea.orgiea.org.

Policy support is also pushing stationary fuel cells. For instance, New York State in 2025 announced $3.7 million in funding for innovative hydrogen fuel cell projects to enhance grid reliability and decarbonize industry nyserda.ny.gov. “Under Governor Hochul, New York is examining every resource, including advanced fuels, to deliver clean energy,” said Doreen Harris, NYSERDA’s CEO, calling investment in hydrogen fuel cells “a high value proposition that has the potential to reduce reliance on fossil fuels, contribute to grid reliability, and make our communities healthier.” nyserda.ny.gov The program is soliciting designs for fuel cell systems that can serve as “firm capacity for a balanced electricity grid” or decarbonize industrial processes nyserda.ny.gov. This highlights a recognition that fuel cells can provide on-demand power (capacity) without emissions, an increasingly important attribute as coal plants retire. Similarly, the United States Hydrogen Alliance notes that states like NY are “demonstrating how targeted state action can accelerate national progress toward a resilient, low-carbon energy economy” by advancing scalable fuel cell tech for grid and industrial uses nyserda.ny.gov. In Asia, Japan’s new hydrogen strategy (2023) calls for greater use of fuel cells in both power and mobility, and China’s 14th Five-Year Plan explicitly includes hydrogen as a key for decarbonizing industry and supporting energy security payneinstitute.mines.edu.

To sum up, stationary fuel cells are steadily moving from pilot phase to practical deployment. They fill important roles: providing clean backup power, enabling on-site generation with heat recovery (boosting efficiency), and potentially acting as the bridge between intermittent renewables and reliable grids. They also decentralize power generation, increasing resilience – a big focus after events like the Texas 2021 grid blackout. As costs decline and fuel availability improves (especially green hydrogen or biogas supply), we can expect fuel cells to power more of our buildings and critical facilities. Indeed, the outlook is that by 2030s, fuel cells could account for many gigawatts of distributed generation capacity worldwide, forming a quiet but crucial pillar of the clean energy infrastructure.

Portable and Off-Grid Fuel Cell Applications

Not all fuel cells are large or vehicle-mounted; a significant area of development is portable fuel cells for off-grid, consumer, or military use. These range from pocket-sized chargers to 1–5 kW generators you can carry. The appeal is to provide electricity in remote places or for devices without needing heavy batteries or polluting small engines.

- Military and Tactical Use: Soldiers in the field carry heavy loads of batteries to power radios, GPS, night-vision, and other electronics. Fuel cells running on a liquid fuel can lighten that load by producing power on-demand from a small cartridge. The U.S. Army has tested methanol and propane fuel cell units as portable battery chargers – instead of carrying 20 lbs of spare batteries, a soldier might carry a 3-lb fuel cell and some fuel canisters. Companies like UltraCell (ADVENT) and SFC Energy supply units in the 50–250 W range for military users. In 2025, SFC Energy unveiled a next-generation portable tactical fuel cell with up to 100 W output (2,400 Wh energy capacity) – about double the power of its earlier models fuelcellsworks.com. These methanol-fueled systems can silently provide power for days, which is invaluable for covert ops or sensor outposts. The German Bundeswehr, for instance, has widely adopted SFC’s “Jenny” fuel cells to recharge batteries for troops in the field, citing dramatically reduced battery logistics. Similarly, the U.S., UK, and others have programs to develop “man-portable” fuel cells. The main fuel used is methanol or formic acid (as a convenient hydrogen carrier), though some experimental designs use chemical hydride packs to generate hydrogen on the fly. As these devices become more robust and energy dense, they stand to replace many of the small gasoline generators and large battery packs currently used by military and first responders.

- Recreational and Camping: A niche consumer market has emerged for camping fuel cell generators. These are essentially DMFC or PEM systems that can power an RV or cabin quietly and with no fumes, unlike a gas generator. For example, Efoy (by SFC Energy) offers methanol fuel cell units (45–150 W continuous) marketed to RV owners, boaters, and cabin users. They automatically keep a battery bank charged, consuming a few liters of methanol over a week to provide lighting and appliance power off-grid. The convenience of just swapping a methanol cartridge once in a while (instead of running a noisy generator or hauling solar panels) has attracted a small but steady clientele, especially in Europe. These units also appeal for sailboats, where they can trickle-charge batteries silently on long voyages.

- Personal Electronics Chargers: Over the years, companies have demoed small fuel cells to charge or power laptops, phones, and other gadgets. For instance, Brunton and Point Source Power had hydrogen and propane fuel cell camping chargers, and Toshiba famously showed a DMFC prototype laptop in 2005. Uptake has been limited – lithium batteries have improved so much that a fuel cell charger hasn’t been compelling for most consumers. However, the concept still pops up, especially for emergency preparedness (a small fuel cell lantern/USB charger that runs on camp stove fuel, etc.). As an example, Lilliputian Systems developed a butane fuel cell phone charger (the Nectar) which even got FCC approval, but it didn’t reach broad market. The potential remains for portable fuel cells to provide longer device runtimes for specific users (e.g. journalists in the field, expeditions, etc.). A perhaps more promising angle is using hydrogen cartridges: companies are looking at small metal hydride or chemical hydrogen cartridges (about the size of a soda can) that could power a laptop for dozens of hours via a tiny PEM fuel cell. In 2024, Intelligent Energy launched a prototype hydrogen fuel cell range extender for drones and hinted at similar tech for laptops. If hydrogen storage and safety can be miniaturized successfully, we might finally see a commercial fuel cell charger for mainstream electronics emerge, especially as USB devices proliferate.

- Drones and Robotics: We touched on hydrogen drones in the transport section, but from a power source perspective, these are portable fuel cells. High-value drone operations (surveillance, mapping, delivery) benefit from longer flight times that fuel cells enable. Fuel cell packs in the 1–5 kW range have been integrated into multicopters and small aircraft drones. In 2025, Korea’s Doosan Mobility’s hydrogen drone set a record flight of 13 hours (in a multi-rotor configuration) by utilizing a fuel cell and energy-dense hydrogen storage. This is game-changing for applications like pipeline inspection or search-and-rescue drones that normally must land every 20-30 minutes to swap batteries. Another example: NASA’s Jet Propulsion Laboratory has experimented with a fuel cell-powered Mars airplane concept, where the long endurance of a fuel cell could allow a UAV to survey large areas of the Martian surface (using chemical hydrides for hydrogen since there’s no refueling on Mars!). Back on Earth, fuel cells also power some autonomous robots and forklifts indoors, as mentioned – their quick refueling and lack of exhaust make them suitable for warehouses where a robot or forklift can keep working with just a 2-minute hydrogen top-up instead of hours of charging.

- Emergency and Medical Devices: Portable fuel cells have also been trialed for medical equipment (e.g. portable oxygen concentrators or ventilators that normally rely on battery packs). The idea is an extended-life power source for field hospitals or during disasters. Also, fuel cells (with reformers) that run on logistics fuels like propane or diesel are in development for disaster response. For instance, the H2Rescue truck mentioned earlier can not only supply power but also produce water – both critical needs in emergencies innovationnewsnetwork.com. Companies like GenCell offer an alkaline fuel cell generator that can run on ammonia – a widely available chemical – as an off-grid power solution in remote communities or emergency situations. Ammonia cracking produces hydrogen for the fuel cell, and the system can provide continuous power for critical loads when infrastructure is down.

The portable fuel cell market is still relatively small, but growing. One report valued it at $6.2 billion in 2024 with ~19% annual growth expected through 2030 maximizemarketresearch.com, as more industries adopt these niche solutions. The demand is fragmented across military, recreational, drone, and backup power uses. But all share the common theme: fuel cells can deliver clean, quiet, long-running power in situations where batteries fall short and generators are undesirable. The technology has matured to the point that reliability is high (companies often advertise 5,000-10,000 hour stack life for their portable units now) and operation is simplified (hot-swappable fuel cartridges, self-starting systems, etc.). For instance, newer DMFC designs have improved catalysts and membranes that boost performance; researchers are finding ways to mitigate the notorious methanol crossover and increase efficiency techxplore.com. This is making products more appealing and cost-effective. As one tech review noted, DMFCs and other portable fuel cells have “better performance and lower cost than before, making them suitable for large-scale use” in certain niches ts2.tech.

In conclusion, portable fuel cells may not replace the battery in your smartphone any time soon, but they are quietly enabling a host of specialized tasks – from soldiers staying powered on long missions, to drones flying farther, to campers enjoying silent off-grid power, to first responders keeping lifesaving equipment running after a storm. As fuel availability (especially hydrogen and methanol cartridges) improves and volumes increase, these portable and off-grid applications are likely to expand further, complementing the broader fuel cell ecosystem.

Technological Innovations Driving Fuel Cells Forward

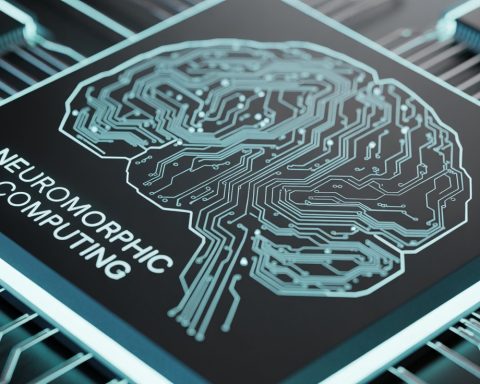

The advancements in fuel cell technology in recent years have been pivotal in addressing past limitations of cost, durability, and performance. Researchers and engineers worldwide are innovating across materials science, engineering design, and manufacturing to make fuel cells more efficient, affordable, and longer-lasting. Here we highlight some key technological innovations and breakthroughs accelerating fuel cell development:

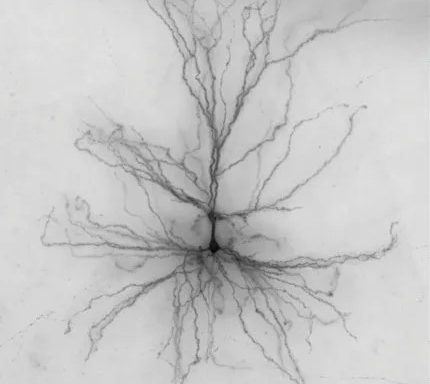

- Catalyst Reduction and Alternatives: A major cost driver for PEM fuel cells is the platinum catalyst used for the reactions. Significant R&D has aimed at reducing platinum content or replacing it. In 2025, a team at SINTEF (Norway) reported a remarkable achievement: by optimizing the arrangement of platinum nanoparticles and membrane design, they achieved a 62.5% reduction in platinum loading in a PEM fuel cell while maintaining performance norwegianscitechnews.com. “By reducing the amount of platinum in the fuel cell, we’re not only helping to reduce costs, we’re also taking into account global challenges regarding the supply of important raw materials and sustainability,” explained Patrick Fortin, SINTEF researcher norwegianscitechnews.com. This “razor-thin” new membrane technology they developed is only 10 micrometers thick (about 1/10th the thickness of a sheet of paper) and required coating the catalyst very uniformly to ensure output remained high norwegianscitechnews.com. The result is a cheaper, more environmentally friendly membrane-electrode assembly that still delivers the needed power. Such breakthroughs bring down costs and reduce dependency on scarce platinum (a critical raw material mostly mined in South Africa/Russia). In parallel, researchers are exploring platinum-group-metal-free (PGM-free) catalysts using novel materials (e.g. iron-nitrogen doped carbons, perovskite oxides) to eventually eliminate platinum entirely. Some experimental PGM-free cathodes have shown decent performance in labs, but durability is a challenge – yet progress is steady.

- New Membranes and PFAS-Free Materials: PEM fuel cells traditionally use Nafion and similar fluorinated polymer membranes. However, these fall under the PFAS category (“forever chemicals”) which pose environmental and health risks if they degrade. Efforts are underway to develop PFAS-free membranes that are just as effective. The SINTEF innovation mentioned above not only thinned the membrane by 33% (improving conductivity and reducing material usage), but those membranes also contained less fluorine, thereby cutting potential PFAS risk norwegianscitechnews.com. The EU is even considering restrictions on PFAS, so this is timely. Other companies are trialing hydrocarbon-based membranes or composite membranes that avoid PFAS entirely. Improved membranes also allow higher operating temperatures (above 120°C for PEM, which aids waste heat usage and tolerance to impurities). One exciting development are anion exchange membranes (AEMs) for alkaline membrane fuel cells – these can use cheaper catalysts and might allow using impure hydrogen. The challenge with AEMs has been chemical stability, but recent progress has yielded more durable AEM polymers that have crossed 5,000-hour lifetimes in tests, inching closer to PEM reliability.

- Durability Enhancements: Fuel cell stacks must last longer to be economically viable, especially for heavy-duty and stationary applications. Innovations to improve durability include better bipolar plate coatings (to prevent corrosion), catalyst supports that resist carbon corrosion, and using proprietary additives in electrolytes to minimize degradation. For instance, Toyota’s latest Mirai fuel cell stack reportedly doubled durability relative to the first gen, now targeting 8,000–10,000 hours (equivalent to 150k+ miles in a car). In heavy-duty cells, companies like Ballard and Cummins have introduced robust membranes and corrosion-resistant components designed for 30,000 hours. Freudenberg’s heavy-duty fuel cell mentioned earlier uses a special electrode design and humidifier system to reduce degradation at high loads sustainable-bus.com. The U.S. DOE’s Million Mile Fuel Cell Truck program has set a target of 30,000-hour truck fuel cells (around 1 million miles of driving). In 2023, that consortium announced it had developed a new catalyst that delivers “2.5 kW per gram of platinum” – triple the conventional catalyst power density – while meeting durability and cost goals innovationnewsnetwork.com. They are now offering that technology for licensing, which could significantly boost the durability and lower cost of next-gen truck fuel cells. Additionally, advanced diagnostics and control algorithms are helping extend life; modern systems can dynamically adjust operating conditions to minimize stress on the fuel cell (for example, avoiding quick freezes or limiting voltage spikes that cause degradation).

- Higher Temperature PEM and CO Tolerance: Operating PEM fuel cells at >100°C is desirable (better heat recovery, simpler cooling, and tolerance to some impurities). Researchers have developed phosphoric acid-doped polybenzimidazole (PA-PBI) membranes that enable PEM fuel cells to run at 150–180°C. Several firms (like Advent Technologies) are commercializing these High-Temperature PEM (HT-PEM) fuel cells, which can even use reformed methanol or natural gas as fuel because they tolerate up to 1–2% carbon monoxide that would poison a standard PEM energy.gov. HT-PEM systems are showing promise especially for stationary and maritime APUs, though their lifetimes aren’t yet as long as low-temp PEM.

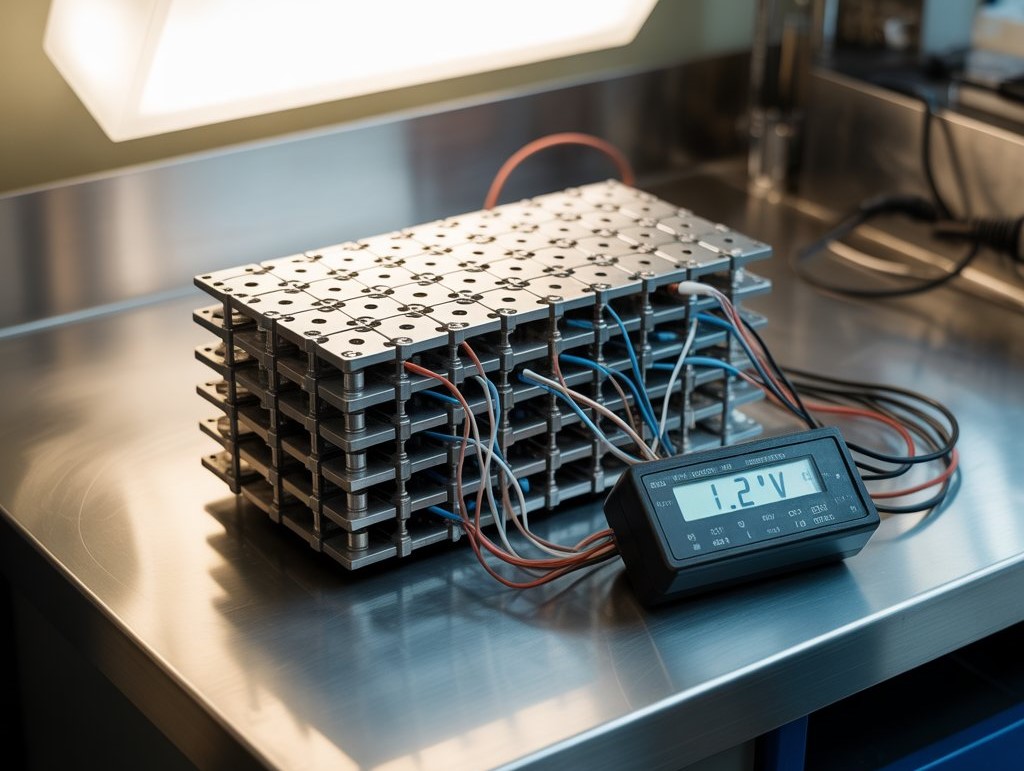

- Manufacturing and Scale-Up: Much innovation is about making fuel cells easier and cheaper to produce. Companies have refined automated MEA fabrication (membrane electrode assembly), including roll-to-roll coating of catalyst and improved quality control (machine vision inspecting every membrane for flaws). Bipolar plate manufacturing has also improved – stamping thin metal plates is now common (replacing more expensive machined graphite plates), and even plastic composite plates are being tested. Stacks are designed for high-volume assembly. Toyota’s latest stack, for example, reduced part count and uses molded carbon-polymer bipolar plates that are lighter and simpler. These advances are pushing down the cost per kilowatt. In 2020 the DOE estimated an automotive PEMFC stack could cost ~$80/kW at volume; by 2025, industry targets are under $60/kW at 100k units/year and under $40/kW by 2030, which would make FCEVs cost-competitive with combustion engines innovationnewsnetwork.com. In manufacturing innovation, we should also note 3D printing: researchers have begun 3D-printing fuel cell components, like intricate flow field plates and even catalyst layers, potentially reducing waste and allowing novel designs that improve performance (e.g., optimized flow channels for uniform gas distribution).

- Recycling and Sustainability: As fuel cell deployments grow, attention is turning to end-of-life recycling of stacks to reclaim valuable materials (platinum, membranes). New methods are emerging – for instance, a 2025 report highlighted a “sound-wave” technique to separate and recover catalyst materials from used fuel cells fuelcellsworks.com. The IEA notes that recycling platinum from fuel cells is feasible and will be important to minimize the need for virgin platinum if millions of FCEVs are produced. Meanwhile, some companies are focusing on green manufacturing: eliminating toxic chemicals from the production process (especially relevant to older PFAS-containing membranes) and ensuring fuel cells live up to their clean image across the lifecycle.

- System Integration & Hybridization: Many fuel cell systems are now smartly integrated with batteries or ultracapacitors to handle transient loads. This hybrid approach allows the fuel cell to run at steady optimal load (for efficiency and longevity) while a battery handles peaks, thereby improving overall system response and life. For example, virtually all fuel cell cars are hybrids (the Mirai has a small battery to capture regen braking and boost acceleration). Even fuel cell buses and trucks often include a lithium-ion buffer. Advances in power electronics and control software make this seamless. Additionally, integration with electrolyzers and renewable sources is a hot area of innovation – creating virtual closed loops where excess solar produces hydrogen via electrolysis, stored hydrogen feeds fuel cells for power at night, etc. The concept of reversible fuel cells (solid oxide or PEM that can run backward as electrolyzers) is one cutting-edge tech being explored to simplify such systems energy.gov. Several startups have prototype reversible SOC (solid oxide cell) systems now.

- New Fuels and Carriers: Innovation isn’t limited to hydrogen gas as the fuel. Alternatives like ammonia-fed fuel cells are being studied (cracking ammonia to hydrogen within a fuel cell system, or even direct ammonia fuel cells with special catalysts). If successful, this could leverage ammonia infrastructure for energy transport. Another novel idea: liquid organic hydrogen carriers (LOHCs) that release hydrogen to a fuel cell on-demand with a catalyst. In 2023, researchers also demonstrated a direct formic acid fuel cell that could reach high power density – formic acid carries hydrogen in liquid form and could be easier to handle than H₂. None of these are commercial yet, but they point to flexible fuel options in the future, which could accelerate adoption by using whichever hydrogen carrier is most convenient for a given application.

- Fuel Cell Recycling & Second Life: On the sustainability front, since fuel cell stacks gradually degrade, another idea is to redeploy used automotive fuel cells into lower-demand applications as a second-life (similar to how EV batteries get a second life in stationary storage). For example, a car’s fuel cell that has dropped below 80% of its initial performance (end of life for driving) could still be used in a home CHP unit or backup generator. This requires modular design to easily refurbish or re-stack cells. Some automakers have indicated interest in this to improve overall economics and sustainability of the fuel cell lifecycle.

Many of these innovations are supported by collaborative efforts. The Fuel Cell & Hydrogen Joint Undertaking in the EU and the U.S. DOE consortia bring together national labs, academia, and industry to tackle these technical challenges. For instance, the DOE’s Fuel Cell Consortium for Performance and Durability (FC-PAD) has been focusing on understanding degradation mechanisms to inform better materials. In Europe, projects like CAMELOT (mentioned in the SINTEF case) aim to push PEMFC performance limits by novel designs norwegianscitechnews.com.

It’s also worth noting the rapid progress in electrolyzers (the mirror technology to produce hydrogen). While not fuel cells per se, improvements in electrolyzer tech (like cheaper catalysts, new membrane types, and ability to use impure water ts2.tech) directly benefit the fuel cell ecosystem by making green hydrogen cheaper and more accessible. The IEA reported that global electrolyzer manufacturing is expanding 25-fold, which will drive down green hydrogen cost and thus encourage more fuel cell adoption innovationnewsnetwork.com. Techniques like using AI for system control and digital twins for predicting maintenance are also being applied to fuel cell systems to maximize uptime and performance.

All told, the continuous innovation has led to tangible improvements: modern fuel cells have roughly 5× the lifespan and 3× the power density at a fraction of the cost compared to those from 20 years ago. As Prof. Gernot Stellberger, CEO of EKPO Fuel Cell Technologies, summarized in an industry letter: “At EKPO, we make the fuel cell competitive – in terms of performance, cost and reliability.” But he notes that to realize the benefits, “hydrogen mobility is ready for deployment, but it requires decisive policy support to bridge the initial cost gap.” hydrogen-central.com This underscores that technology is only one side of the coin; supportive policies are needed to scale up manufacturing so that these innovations truly pay off in cost reduction. We will examine policy and economic aspects next, but from a technology standpoint, the fuel cell field is vibrant, with breakthroughs coming from materials labs, startup garages, and corporate R&D centers alike. These innovations give confidence that the classic challenges of fuel cells (expense, longevity, catalyst reliance) can be overcome, opening doors for widespread use.

Environmental Impact of Fuel Cells

Fuel cells are often touted as “zero-emission” energy devices – and indeed, when running on pure hydrogen, their only byproduct is water vapor. This offers tremendous environmental benefits, especially in eliminating air pollutants and greenhouse gases at point of use. However, to fully assess environmental impact, one must consider the fuel production pathway and lifecycle factors. Here we discuss the environmental pros and cons of fuel cells and how they fit into the broader decarbonization puzzle:

- Zero Tailpipe/Local Emissions: Fuel cell electric vehicles (FCEVs) and fuel cell power plants produce no combustion emissions on-site. For vehicles, this means no CO₂, no NOₓ, no hydrocarbons, no particulate matter coming out of a tailpipe – only water. In urban areas struggling with air quality, this is a huge advantage. Each fuel cell bus that replaces a diesel bus eliminates not just CO₂ but also harmful diesel soot and NOₓ that cause respiratory issues. The same goes for stationary applications: a fuel cell running on hydrogen in a city center yields clean power without the pollution of a diesel generator or microturbine. This can markedly improve air quality and public health, particularly in densely populated or enclosed environments (e.g., warehouse forklifts – swapping propane forklifts for fuel cells means no more carbon monoxide buildup indoors). Fuel cell systems are also quiet, reducing noise pollution compared to engine generators or vehicles.

- Greenhouse Gas Emissions: If the hydrogen (or other fuel) is produced from renewable or low-carbon sources, fuel cells offer a pathway to deep decarbonization of energy use. For example, a fuel cell car running on hydrogen from solar-powered electrolysis has near-zero lifecycle CO₂ emissions – truly green mobility. An International Energy Agency scenario for net-zero 2050 relies on hydrogen and fuel cells to decarbonize heavy transport and industry, where direct electrification is tough iea.org. However, the source of hydrogen is crucial. Today, around 95% of hydrogen is made from fossil fuels (natural gas reforming or coal gasification) without CO₂ capture iea.org. This “grey” hydrogen produces significant CO₂ upstream, roughly 9-10 kg CO₂ per kg H₂ from natural gas. Using such hydrogen in a fuel cell vehicle would actually result in lifecycle emissions comparable to or higher than a gasoline hybrid car – effectively shifting emissions from tailpipe to hydrogen plant. Thus, to realize the climate benefits, the hydrogen must be low-carbon: either “green hydrogen” via electrolysis with renewable electricity, or “blue hydrogen” via fossil production with carbon capture and storage. Currently, low-emission hydrogen plays only a marginal role (<1 Mt out of ~97 Mt total hydrogen in 2023) iea.org, but a wave of new projects is underway that could drastically change this by 2030 iea.org. The IEA notes that announced projects, if realized, would lead to a fivefold increase in low-carbon hydrogen production by 2030 iea.org. Additionally, policies like the US Inflation Reduction Act’s hydrogen tax credit (up to $3/kg for green H₂) and the EU’s hydrogen strategy are racing to boost clean H₂ supply iea.org. In the meantime, some fuel cell projects use “transitional” fuels: e.g., many stationary fuel cells run on natural gas but achieve CO₂ reductions by being more efficient than a combustion plant (and in co-generation mode, by displacing separate heat generation). For instance, a 60% efficient fuel cell emits about half the CO₂ per kWh of a 33% efficient grid power plant on the same fuel energy.gov. If coupled with biogas (renewable natural gas from waste), then the fuel cell can even be carbon-neutral or carbon-negative. Many Bloom Energy servers, for example, are fueled by biogas from landfills. In California, fuel cell projects often use directed biogas to claim very low CO₂ footprints.

- Hard-to-Abate Sectors: Fuel cells (and hydrogen) enable decarbonization where other means falter. For heavy industries (steel, chemicals, long-haul transport), direct electrification is difficult, and biofuels have limits. Hydrogen can replace coal in steelmaking (via direct reduction) and fuel cells can provide high-temperature heat or power with no emissions. In trucking, batteries might not handle 40-ton payloads over 800 km without impractical weight; hydrogen in fuel cells can. The IEA emphasizes that hydrogen and hydrogen-based fuels “can play an important role in sectors where emissions are hard to abate and other solutions are unavailable or difficult”, like heavy industry and long-distance transport iea.org. By 2030 in IEA’s net-zero scenario, those sectors account for 40% of hydrogen demand (versus <0.1% today) iea.org. Fuel cells are the devices that will convert that hydrogen into usable energy for those sectors cleanly.

- Energy Efficiency and CO₂ per km: On an efficiency note, fuel cell vehicles are generally more energy efficient than combustion engines but less efficient than battery electrics. A PEM fuel cell car might be ~50–60% efficient converting hydrogen’s energy to wheel power (plus some loss in making hydrogen). A BEV is 70-80% efficient grid-to-wheels, whereas a gasoline car is maybe 20-25%. So even using hydrogen from natural gas in a fuel cell car yields a CO₂ reduction relative to a comparable gasoline car, due to higher efficiency, but not as much as using renewable hydrogen. With renewable hydrogen, well, the CO₂ per km is near zero. Also, because fuel cells maintain high efficiency even at part load, an FCEV in city driving can have a smaller efficiency penalty than an ICE vehicle in stop-and-go traffic.

- Pollutants and Air Quality: We covered tailpipe pollutants, but also consider upstream. Making hydrogen from natural gas does emit CO₂ (unless sequestered) but doesn’t emit local pollutants that affect human health. Coal gasification for hydrogen, used in some places, does have significant pollutant emissions unless cleaned – but that method is declining due to its high CO₂ footprint. On the other hand, electrolysis has almost no environmental emissions if powered by renewables (there may be some water vapor from cooling towers if it’s a large plant, but that’s minor). Water use is another aspect: fuel cells themselves produce water rather than consume it (a PEM fuel cell produces about 0.7 liters of water per kg of H₂ used). Electrolysis to make hydrogen requires water input – roughly 9 liters per kg H₂. If hydrogen is made from natural gas, it produces water rather than consuming it (CH₄ + 2O₂ -> CO₂ + 2H₂O). So water impact depends on pathway: green hydrogen uses water (but relatively modest amounts; e.g., producing 1 ton of H₂ (which is a lot of energy) uses about 9-10 tons of water, which is equivalent to what producing 1 ton of steel uses, to compare). Some companies are finding ways to use wastewater or even seawater for electrolysis (recent breakthrough let PEM electrolyzers run on impure water ts2.tech). Overall, hydrogen/fuel cells are not very water-intensive compared to, say, biofuels or thermal power plants, and in some applications fuel cells can even provide water. The Toyota Tri-gen system, for example, yields 1,400 gallons of water per day as a byproduct which they use to wash cars pressroom.toyota.com.

- Material and Resource Impacts: Fuel cells do use some exotic materials (platinum group metals) but in small quantities. As mentioned, those are being reduced and can be recycled. From a resource perspective, a future where millions of fuel cell cars exist would need scaling up platinum supply somewhat, but estimates show it could be on the order of a few additional hundred tons by 2040, which is feasible especially with recycling (contrast with batteries that require large quantities of lithium, cobalt, nickel, etc., prompting their own sustainability questions). Also, fuel cells can reduce dependence on certain critical minerals: for instance, an FCEV doesn’t need lithium or cobalt at scale (just a small battery), potentially easing demand on those supply chains if FCEVs take a significant share. Hydrogen itself can be produced from a variety of local resources (renewable power, nuclear, biomass, etc.), enhancing energy security and reducing the environmental impacts of petroleum extraction/ refining. Regions with abundant renewables (sunny deserts, windy plains) can export energy via hydrogen without laying massive transmission lines.

- Comparison to Alternatives: It’s worth comparing fuel cells with other solutions like battery EVs or biofuels from an environmental lens. BEVs have higher efficiency but face manufacturing impacts (mining for large batteries, etc.) and still require a clean grid to truly be low-carbon. Fuel cells shift the environmental burden to hydrogen production – which if done cleanly, can be very low impact. In practice, a mix will likely exist. Many experts see fuel cells and batteries as complementary: batteries for shorter ranges and light vehicles, fuel cells for heavier, long-range needs. That combined approach, as that EU CEOs letter highlighted, could actually minimize total system costs and infrastructure – and presumably environmental impact – by using each where it’s optimal hydrogen-central.com.

- Hydrogen Leakage: A subtle environmental consideration being researched is the effect of hydrogen leakage on the atmosphere. Hydrogen itself is not a greenhouse gas, but if leaked, it can extend the life of methane and contribute indirectly to warming. Studies are examining this risk; the Hydrogen Council notes that keeping leakage low (which is achievable with good engineering) is important. Even so, the worst-case warming effect of leaked H₂ is much lower than CO₂ or methane leaks of equivalent energy content. Nonetheless, industry is developing sensors and protocols to minimize any losses in production, transport, and use of hydrogen.

In aggregate, the environmental outlook for fuel cells is very positive provided the hydrogen comes from clean sources. That is why so much investment is going into scaling up green hydrogen. The International Energy Agency stresses that while momentum is strong (with 60 countries having hydrogen strategies) we must “create demand for low-emissions hydrogen and unlock investment to scale-up production and bring down costs”, otherwise the hydrogen economy won’t achieve its environmental promise iea.org. Currently, a mere 7% of announced low-carbon hydrogen projects have reached final investment decisions, often due to lack of clear demand or policy support iea.org. This is a gap being addressed now by policies (more on that in the next section).

One can see the rapid shift: for example, in early 2025 the U.S. Treasury finalized rules for the hydrogen production tax credit in the IRA, giving certainty to investors iea.org. Europe launched its Hydrogen Bank auctions to subsidize green H₂ offtake iea.org. These actions should catalyze more low-carbon hydrogen, which directly improves the environmental footprint of every fuel cell deployed. Already, global investment in low-emission hydrogen is set to jump ~70% in 2025 to almost $8 billion, following a 60% surge in 2024 ts2.tech. In short, the cleaner the hydrogen, the greener the fuel cell – and the entire industry is moving swiftly to ensure hydrogen supplies will be clean.

From a broader perspective, fuel cells contribute to environmental sustainability not just via emissions, but by enabling energy diversification and resilience. They can utilize surplus renewable energy (preventing waste/curtailment), and provide clean power in remote or disaster-hit locations (supporting human and ecosystem needs). When paired with renewables, they make it feasible to phase out fossil fuels in sectors once deemed intractable, cutting both pollution and climate impact. As Air Liquide’s CEO François Jackow succinctly put it: “Hydrogen is a key decarbonization lever for industry and mobility, and a pillar for future energy and industrial resilience.” hydrogen-central.com Fuel cells are the workhorses that turn that hydrogen into practical power without pollution.

In conclusion, fuel cell technology offers significant environmental upsides: clean air, lower greenhouse emissions, and integration of renewables. The main caution is to avoid simply shifting emissions upstream by using fossil hydrogen – a transitional issue that robust policy and market trends are actively addressing. With green hydrogen scaling, fuel cells stand to deliver truly zero-carbon energy across many uses. The combination of no tailpipe emissions and increasingly zero-carbon fuel supply makes fuel cells a cornerstone of many national climate strategies and corporate sustainability plans. It’s clear that when it comes to cutting pollution and combating climate change, fuel cells are more of an ally than a threat – a conclusion echoed by scientists and policymakers around the world.

Economic Feasibility and Market Trends

The economics of fuel cells have long been a subject of scrutiny. Historically, fuel cells were expensive, high-tech curiosities affordable only for space missions or demonstration projects. But over the past decade, costs have fallen significantly, and many fuel cell applications are nearing economic viability – especially with supportive policies and at higher production volumes. Here, we evaluate the economic feasibility of fuel cells across sectors, and examine the current market trends including investments, growth projections, and how policy initiatives are shaping the market.

Cost Trajectories and Competitiveness

Costs of fuel cell systems are measured in cost per kilowatt (for stationary and automotive stacks) or total system cost per unit (for things like a bus or car). Several factors have contributed to cost reduction:

- Volume production: As production scales from dozens to thousands of units, manufacturing efficiencies kick in. Toyota, for example, has cut the Mirai fuel cell stack cost by an estimated 75% from the first generation to the second by mass production and design simplification. Still, FCEVs remain more expensive upfront than comparable combustion or even battery vehicles due to low volumes and costly components (the Mirai costs around $50k+ before incentives). The U.S. DOE targets cost parity with ICE at high volumes by 2030 (~$30/kW for fuel cell system).

- Platinum reduction: We discussed technical cuts in platinum; economically, platinum is a big part of stack cost. Reducing loading or using recycled platinum can shave thousands off a stack cost. At present, an 80 kW automotive fuel cell might have 10-20 g of platinum (depending on design) – at $30/gram, that’s $300-600 of platinum, which is not huge but noteworthy. For heavy-duty, stacks are larger but efforts are in place to keep platinum per kW dropping. Meanwhile, stationary MCFCs and SOFCs avoid platinum entirely, which helps on the materials cost side (though they have other costly materials and assembly processes).

- System Balance of Plant (BoP): Non-stack components like compressors, humidifiers, power electronics, tanks, etc., contribute a lot to cost. Here too, volume and supply chain maturity help. In vehicles, the carbon-fiber hydrogen tanks are a major cost (often as much as the fuel cell stack itself). Those costs are falling ~10-20% per doubling of volume. The industry is researching alternative storage (like metal hydrides or cheaper fiber) but in near term it’s about scaling composites production. The EU and Japan have programs to halve tank costs by 2030 through automation and new materials. On the stationary side, BoP includes reformers (if using natural gas), inverters, heat exchangers – again benefitting from standardization and scale.